Exness Review 2021

Exness is a market maker forex & CFD broker offering more than 100 forex pairs. The spreads are very low and traders can start with a minimum deposit of 1$. Read our detailed review of Exness for Filipino traders before opening your account.

Exness is an CFD broker that offers trading on a wide range of currency pairs & other CFDs. Exness was founded in 2008 and is a well-regulated entity.

Exness is a good option for beginners as it accepts a minimum deposit as low as 1$. The spreads are slightly lower than many of the peers while the maximum available leverage is very high.

Being a market maker, it matches the clients’ orders and, in some cases, can also take the opposite position of the clients. It does not pass on the order to banks or other liquidity providers.

We tested Exness’s fees, safety & more for traders in Philippines. Our review is data based, We have covered all the features and conditions that can affect the trading experience of Filipino clients.

Exness Philippines Pros

- Exness is a regulated CFD broker. They are licensed by FCA, FSCA, and CySEC

- The spreads at Exness are among the lowest in the market

- 5 choices of live trading account

- English Customer support through live chat & is available 24/5.

- Minimum deposits as low as $1 with Standard accounts.

- Multiple deposits and withdrawal methods accepted

- More than 100 currency pairs can be traded

Exness Philippines Cons

- No local office in the Philippines

- No local phone number for support, you need to call their international phone number.

- Live chat is slow to connect

- No bonus offered

- Philippine Peso cannot be chosen as the base currency of the account

Exness Philippines – General Information

| 👌 Our verdict | #3 CFD Broker in the Philippines |

| 🏦 Broker Name | Exness Philippines |

| 💵 EURUSD Spread (Average) | 1 pips (with Standard MT4 Account) |

| 📅 Year Founded | 2008 |

| 🌐 Website | www.exness.com |

| 💰 Exness Minimum Deposit | $1 |

| ⚙️ Maximum Leverage | 1:2000 |

| ⚖️ Regulations | CySEC, FSA, FSCA |

| 🛍️ Available Trading Instruments | 100+ currency pairs, 100+ CFDs on Indices, Cryptos, Metals, etc. |

| 📱 Trading Platforms | MT4 & MT5 for desktop, web & mobile |

Is Exness Safe for traders in Philippiines?

Forex and CFD markets are unregulated in Philippines. The SEC of Philippines is not responsible for any scams or deceitful activity by the broker, but traders can participate at their own risk. Under such a case, it is essential to choose a broker that is regulated by a foreign top-tier regulatory authority.

Exness is regulated 3 of the highly trustworthy regulatory authorities:

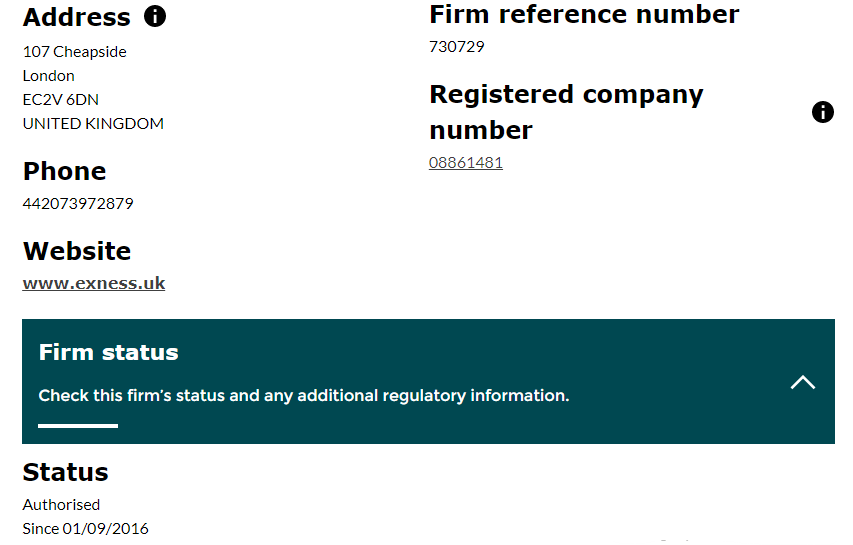

- FCA: Exness has acquired a regulatory license from the UK’s Financial Conduct Authority. Their license number is 730729.

- FSCA: Exness is authorized by the Financial Sector Conduct Authority of South Africa with FSP number 51024.

- CySEC: Exness is regulated by Cyprus Securities and Exchange Commission & their license number is 178/12.

Due to multiple top-tier regulations, Exness can be considered safe forex and CFD broker. The company is headquartered in Seychelles. The broker has been offering trading services since 2008 and has served thousands of clients worldwide.

We found a majority of the reviews by the existing clients to be positive. The broker regularly updates its financial statements on its website along with an audit report by Deloitte. This makes Exness more transparent than any other market maker broker in the Philippines.

In general, STP and ECN brokers are considered more reliable as they do not participate in a trade. However, Exness is a well-regulated, transparent, and reliable broker that is considered safe despite being a market maker.

Fees

For a detailed review of all the costs incurred to traders in Philippines, we have divided the fees into trading fees & non-trading charges.

Trading Fees at Exnesss is low

This includes spreads and commission as these are charged only when a trade order is executed. At Exness, trading fees can differ depending on the account type chosen by the trader. Hence, we will be discussing trading fees for each account type.

- Standard and Standard Cent Account: The standard and standard cent account at Exness offers similar features with the same fees at no trading commission. The spreads on currency pairs start from 0.3 pips. For EUR/USD, we found the average typical spread to be 1 pip for both the account types.

- Raw Spread and Zero Account: We found that the Raw spread and zero account types under the professional accounts section are quite similar in terms of pricing. Both the accounts offer spreads as low as 0 pip. The spreads on many of the currency pairs and CFDs are slightly lower with the Zero spread account. For EUR/USD, the average spread is 0 for Raw spread as well as Zero spread account type.

Both the accounts have a commission of $3.5 per standard lot per side for a single side of the trade. This means for a round trade (opening and closing the position), 7$ is charged for a whole standard lot with Raw and Zero spread account.

- Pro Account: Pro account is the most cost-effective out of all the account types at Exness as no commission is charged on trading CFDs and currency pairs with spreads as low as 0.1 pip. The average spread on EUR/USD is 0.6 pips with no commission.

Non-Trading Fees at Exness

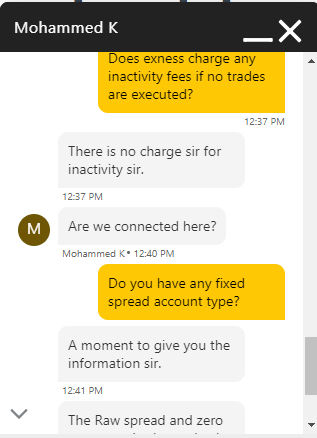

Exness does not charge any commission for account opening, maintenance, deposits, and withdrawals. Unlike many forex brokers, it does not charge any inactivity fees.

We couldn’t find any extra non-trading charges at Exness as traders are not charged any fees if they do not participate in trading.

On comparing the trading and non-trading fees at Exness with other brokers, we found it to be very cost-effective. The spreads on the pro account are among the best in the market with no trading commission.

Exness’s Support

The support team at Exness is fair, not the best as per our research. We tried to reach out to the support staff at Exness for a better review of their customer support.

- Live chat is available 24/7 but connection is quite slow: The best part of the live chat at Exness is that it is available 24/7. This means traders can reach out to the executives whenever they wish to. The connectivity can take more than 5 minutes at times, but each query’s response time is 30 seconds on average. The connectivity takes longer during the peak trading hours.

- Email support is slow to respond: Traders in Philippines can also reach out to the support executives at Exness by sending an email at [email protected]. But their support team was slow in responding to our queries during our research.

- No Local Phone in the Philippines: Exness don’t have a local office in Philippines and entirely operates online. They do not have any local phone number for customer support in Philippines. The international helpline number 000-800-100-437 can be dialed to connect with the phone support staff. The con is that International calling charges would apply to you.

Overall, upon comparison with peers, we found the Exness’s support to be decent (not the best, certainly not the worst also). Live chat support is fair, but the unavailability of phone support is the main drawback.

Trading Platform

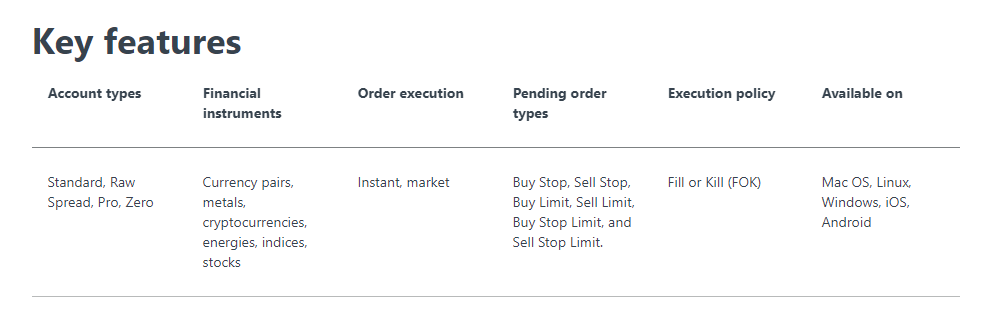

Exness offers the most popular and most preferred Metatrader trading platform that is available for all types of devices. The Metatrader 4 can be chosen with all the 5 account types while the Metatrader 5 is available for all accounts except the Standard Cent account.

The MT4 and MT5 are user-friendly platforms that can be customized on various devices. They offer multiple indicators and research tools. We liked the user-friendly interface and quick execution of trades on both platforms.

Account Types

Traders in the Philippines can choose from a total of 5 account types at Exness. Each account type has been briefly reviewed to allow suitable selection and convenient trading experience of traders.

- Standard Account: This is the basic commission-free account type in which standard lots are traded. It can be opened with a minimum deposit of as low as 1$ depending on the method of transaction. There is no upper limit on leverage and all the trading instrument available can be traded with this account. Traders can open any number of positions simultaneously with the standard account.

- Standard Cent Account: Most of the features like minimum deposit, fees, leverage, etc for the Cent account is the same as the Standard account. The major difference is that it allows trading through cents. The minimum price fluctuation is 0.1 cents. It is also the only account that is supported with MT4 only trading platform. All the other account types can be opened with MT4 as well as the MT5 trading platform. Traders can only trade with Forex and CFDs on Metals with the Cent account.

- Raw Spread Account: The Raw Spread account allows trading with a lower spread with a commission. The account requires a minimum initial deposit of 500$. All the instruments are available to trade with a maximum leverage of 1:2000.

- Zero Spread Account: This account allows spread free trading on more than 95% of the available instruments. It involves a commission and maximum leverage of 1:2000. The minimum deposit requirement for the Zero Spread account is 500$.

- Pro Account: This is the most cost-effective account as it does not involve any commission and includes a low spread. The orders are executed instantly with max leverage of 1:2000. The minimum deposit requirement of the Pro account is also 500$.

Each account type has differing features and can be suitable for different types of traders. The Cent account is ideal for beginners while the standard account is ideal for lesser experienced traders. For high volume traders, the Raw spread and Zero Spread account can be more fruitful. The Pro account offers the best features and can be ideal for new as well as experienced traders due to low spreads and no commission.

Compared to other forex and CFD brokers available in Philippines, we found Exness to be much better than peers in the account offering section as it has different account types that would fit the requirements of traders.

Trading Instruments

Details of all the available trading instruments at Exness are described below:

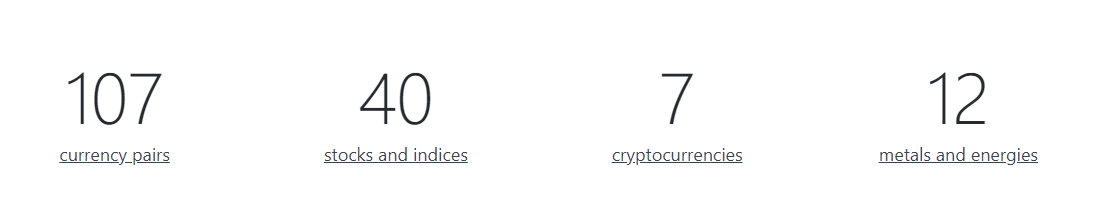

-

Forex: A total of 107 currency pairs are available to trade in Philippines at Exness. This includes the 7 major pairs, 25 minor pairs, and 75 exotic currency pairs. These pairs can be traded with any of the account types.

-

CFDs: A total of 100 CFDs are available to trade at Exness. This includes 81 CFDs of Stocks and indices, 7 CFDs of Cryptocurrencies, and 12 CFDs of metals and energies. The CFDs of stocks, indices, and cryptocurrencies cannot be traded with the Cent account. All the other CFDs are available to trade with any of the account types.

The total currency pairs available to trade at Exness is higher than many of the CFD brokers that accept clients from the Philippines. More instruments mean higher choices for traders.

Research and Education

Exness does organize seminars for educational and promotional purposes but we couldn’t find sufficient research and education tools compared to other brokers.

The Web TV feature on their official websites provides research and analysis reports that are published regularly but it only covers a limited subject matter. The research and education segment of Exness has a lot of margin for improvement.

Deposits and Withdrawals

Multiple methods for deposit and withdrawal are available at Exness in Philippines. Traders can transact through online bank transfer and internet banking from local banks at no extra commission.

Multiple e-wallets can also be used to deposit and withdraw like SticPay, Neteller, Skrill, etc. In cryptocurrency, only Tether (USDT) is supported for deposit as well as withdrawal. The time taken for deposit as well as withdrawal depends on the method chosen but is instant for a majority of the methods.

Compared to other brokers in Philippines, we liked the lower cap on minimum deposit which goes as low as 1$. The speed of transaction is also better than many of the brokers but the non-availability of crypto deposits like BTC, ETH, etc. can be a drawdown.

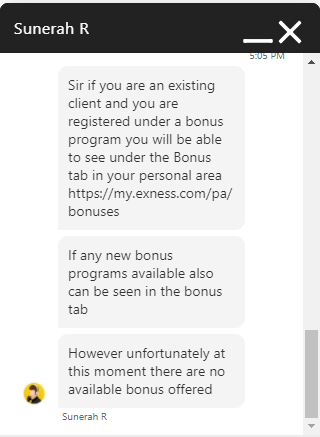

Exness Bonus

We could not find any promotional bonus offering for traders in Philippines when we are writing this review. There is no deposit bonus, loyalty bonus, or referral bonus for any type of trader at Exness.

Do We Recommend Exness Philippines?

Yes, Exness is a well-regulated broker that is providing consistent services all over the world for more than 12 years. Exness offers low spread accounts with no hidden commission on trades with their Standard account type.

The support and research & education can be further improved to assist the traders but Exness is still a better option than many of the forex brokers that accept traders in the Philippines.

Exness Philippines