XM Philippines Review 2021

XM is a low-cost market maker CFD broker that is regulated by multiple top tier regulatory authorities including CySEC & ASIC. Read our review of XM Philippines that includes detailed analysis of cost of trade, regulations, support & every other feature at XM.

XM claims to serve more than 3.5 million clients in 196 countries. It is a market maker forex broker. This means that it matches the suitable orders of clients and sometimes also takes the opposite position of trade.

XM was launched in 2009 and is currently a leading market maker broker in Asia for CFD trading in terms of their average monthly trading volume. They have regulatory licenses from FCA, ASIC, and CySEC. They offer a wide range of trading instruments and excellent customer support to assist the traders at any point in time.

Their official website is available in the Filipino language. But they don’t have any local office address in the Philippines, and there is no local phone support for Philippines listed on their website.

XM has organized various educational seminars in Manila and Davao. The SEC of Philippines advises citizens against trading in forex and CFDs although interested individuals still trade on a mass scale.

We have tried to make this review unbiased & based on data.

XM Philippines Pros

- XM broker is licensed by ASIC, and CySEC

- Spreads as low as 0.6 pips on currency pairs

- Multiple base account currencies available

- Minimum deposit as low as $5

- More than 1200 trading instruments available

- Wide range of research and education tools available

- Helpful support service through live chat

XM Philippines Cons

- XM does not have any local registered office in the Philippines. It works as on offshore broker.

- Unavailability of local phone number in Philippines. But you can request a callback from your account manager.

- Local bank deposit in Philippines and cryptocurrency deposits are not supported

XM Philippines – A quick look

| 👌 Our verdict on XM | #2 Forex Broker in Philippines |

| 🏦 Broker Name | XM Philippines |

| 💵 Typical EURUSD Spread | 1.7 pips (with Micro MT4 Account) |

| 📅 Year Founded | 2009 |

| 🌐 Website | www.xm.com |

| 💰 Minimum Deposit | 5$ |

| ⚙️ Maximum Leverage | 1:888 |

| ⚖️ Regulations | CySEC, FSA, ASIC |

| 🛍️ Trading Instruments | 57 currency pairs, 1200+ CFDs on Stocks, Indices, Cryptos, Metals, etc |

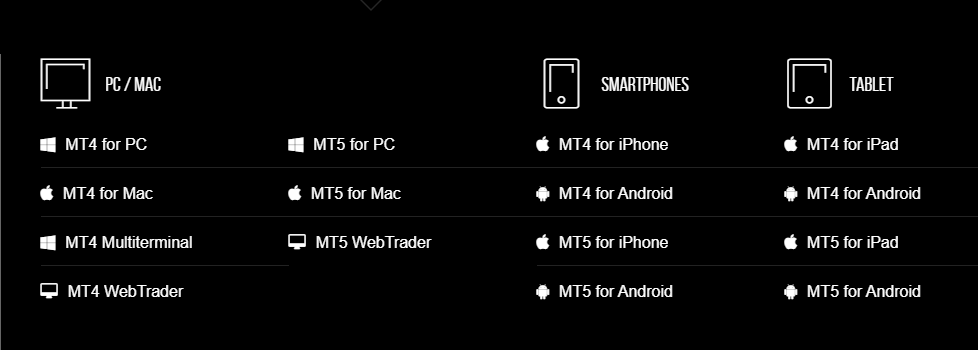

| 📱 Trading Platforms | MT4 & MT5 for desktop, web & mobile |

Is XM Safe for Philippines Traders?

XM is not regulated by government or financial regulatory authority in the Philippines. Their regulation with multiple top-tier regulatory authorities makes them low-risk CFD broker for traders based in the Philippines. If XM indulges in any malpractice or scams, the activity can be reported to the regulatory authorities that have granted license to XM broker.

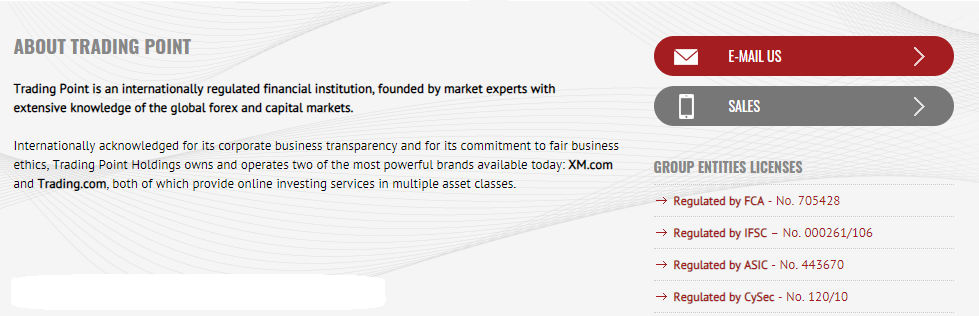

XM is regulated by the following regulatory authorities:

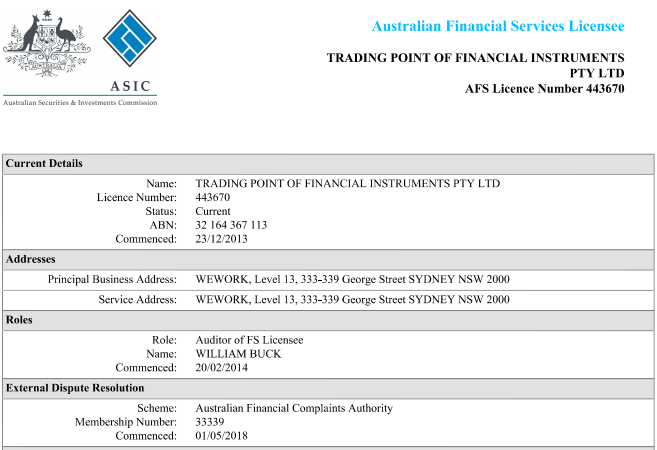

- XM is regulated by ASIC: XM is also regulated by the top-tier Australian Securities and Exchange Commission (ASIC) of Australia & their license number is 443670.

- XM is licensed by CySEC: XM is regulated by Cyprus Securities and Exchange Commission based in Cyprus under license number 120/10.

XM broker is owned by Trading Point Holdings Limited which is headquartered in Cyprus. XM is headquartered in Belize, Central America, and has offices in various cities of the world.

In terms of cons, XM is a market maker broker and can take opposite side of the trading orders made by the traders. XM does not have a parent banking firm nor does it hold any banking license. XM is also not listed on any stock exchange.

The funds are kept in segregated bank accounts to ensure safety.

According to our review, XM can be considered low risk for traders in Philippines due to their multiple regulatory licenses. It is a trustworthy broker that has served a large number of traders worldwide for more than a decade.

XM’s Fees

The trading fee charged at XM is quite simple as it does not charge any commission for executing forex or CFD trades on any of the account types. The commission is only charged with the shares CFD account. For a better explanation of charges incurred to traders in Philippines at XM, we have subdivided the fee structure.

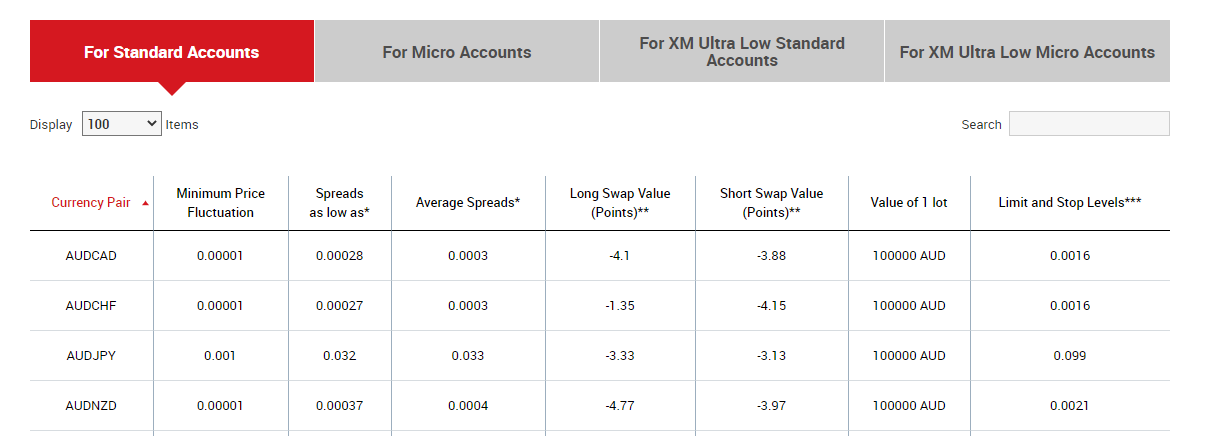

XM’s fees for Trading

The cost incurred to traders while executing trade orders is called trading fees. At XM spread is the only trading fee as no commission is charged on any of the available account types.

At XM, there are mainly 2 types of accounts based on spreads. These 2 accounts are further divided into standard and micro accounts depending on the lot sizes.

- Normal Spread Accounts: The Standard and Micro account types with normal spread are slightly costly as the spreads start from 1 pip. For EUR/USD, we found the average typical spread to be 1.7 pips for both the variant of normal spread accounts.

- Ultra-Low Account: The Ultra-Low account can be opened with a slightly higher minimum deposit in which the spreads are much lower starting from 0.6 pips. For EUR/USD, we found the average typical spread to be 0.7 for the standard as well as a micro variant of Ultra-Low Account.

Non-Trading Fees

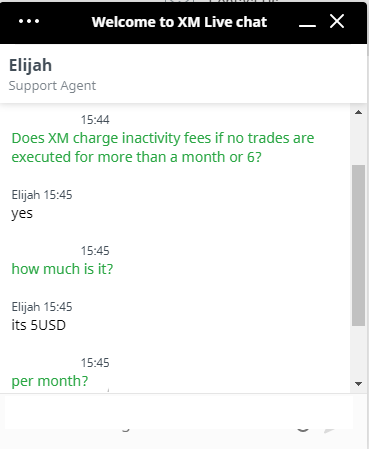

The charges that are incurred to traders without opening a position are grouped under non-trading fees. As there is no fee for account opening, maintenance, deposit, and withdrawal, the non-trading fees at XM are fairly impressive.

The only Non-trading fee is the inactivity fees which are incurred only if no trades are executed for 6 consecutive months. An inactivity fee of 5$ is charged each month until the balance reaches 0 in case of inactivity of more than 6 months. Inactive accounts with 0 balance are automatically closed after 6 months of inactivity.

Overall, the trading fees with the ultra-low account are very cost-effective and among the best in Philippines. Low spreads with no commission involved make the Ultra-Low account most attractive. The spreads on the normal spread Standard and Micro account are slightly higher compared to most of the regulated forex brokers in Philippines.

Trading Platform

XM supports the Metatrader 4 and Metatrader 5 trading platform for all types of devices for any of the account types chosen. MT4 and MT5 are the most popular and widely chosen trading platform that includes various indicators and charting tools. The cTrader trading platform is unavailable at XM.

Customer Support

The customer support service at XM is excellent, and we tested their live chat and email support. We tried reaching out to the support staff at different times and had a great experience as the support staff were friendly & quick to answer our questions.

- English Live Chat is available 24/5: The live chat is available at the official website of XM for 24/5. The chat window is not available on weekends and the query raised through live chat on weekends are automatically converted into tickets that are resolved through email. The average response time was 15 seconds while it took an average of 2 minutes to connect with the executives.

- Email responses are fast: Traders in the Philippines can also reach out to the support staff at XM through email via [email protected]. They generally take 2-4 hours to revert on email but can be sooner or later depending on the business hour.

- No Local Phone Support: XM does not offer a local phone number to Filipino clients as there are no offices in the Philippines. Traders can however call on their international number +501 223-6696, but this might incur international calling charges.

Overall, XM’s support service is much better than many of the other forex brokers in the Philippines.

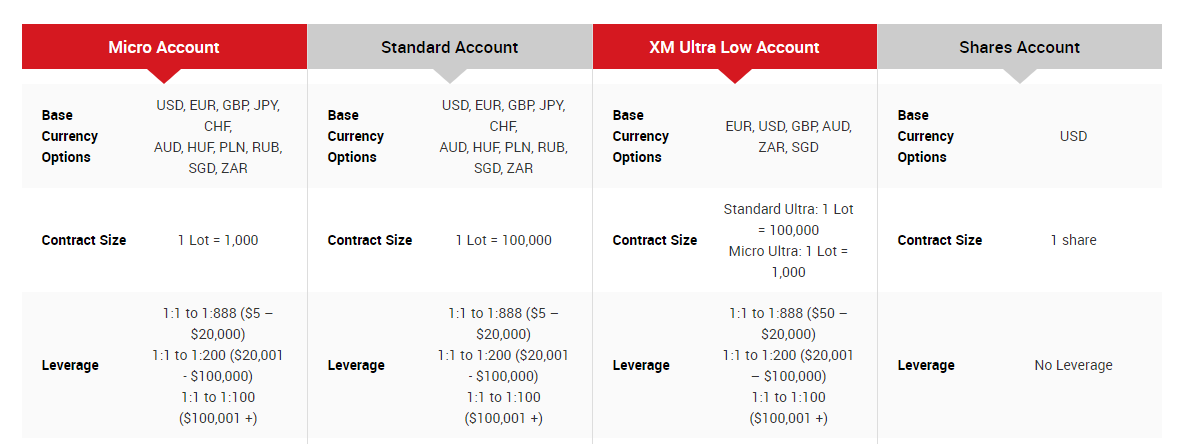

Account Type

A total of 5 live trading accounts and 1 demo account are offered by XM in Philippines. We have comprehensively reviewed the features of each account type to assist the traders in choosing the best one for themselves.

Traders in Philippines must note that the Philippines Peso (PHP) is not available at XM as the base currency of the account.

-

Standard Account: This is the basic account type with a minimum deposit of $5 equivalent. The standard account can be opened with a base currency of USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, and ZAR. The maximum leverage is 1:888 if the trading amount is between 5$ to 20,000$. As per the name, only standard lots can be traded with the Standard account.

-

Micro Account: There is no major difference between the Micro and Standard accounts except for the lot size. Only micro-lots i.e. 1 lot = 1000 units, can be traded with the micro account. The minimum deposit, base currencies, leverage, spreads, and all the other features are the same as the Standard account.

-

Ultra-Low Account: The ultra-low accounts are available in standard as well as micro variants differing based on lot size. The ultra-low account allows trading at a much lower spread without any commission. This account requires a minimum deposit of 50$ equivalent and can be opened with EUR, USD, GBP, AUD, ZAR, and SGD as a base currency. The max leverage is 1:888 for trade value of 50$ – 20,000$ equivalent.

-

Shares Account: This account is specifically structured for trading on shares. Traders cannot trade forex and CFDs with the shares account. It doesn’t offer leverage and the minimum deposit requirement is 10,000$. This account can only be opened with USD as a base currency.

-

Forex: A total of 57 currency pairs can be traded 5 days a week at XM with a maximum leverage of 1:888.

-

Stock CFDs: A total of 1291 CFDs on stocks are available to trade at XM with any of the account types. Stocks of various American and European markets are available to trade at XM through CFDs. Traders must note confuse shares with stock CFDs as shares are traded separately at XM with a different account.

-

Other CFDs: Apart from stock CFDs, 29 more CFDs are available to trade via any account type. Among these, 8 CFDs are commodities, 14 for indices, 2 for precious metals, and 5 CFDs are of energies.

-

Shares: XM also allows Filipino traders to trade on shares without CFDs. A total of 100 stocks are available to trade from the markets of the UK, USA, and Germany. 0.1% of the trading amount is charged as a commission with a minimum commission of 5$.

-

Educational Tools: XM regularly provides learning materials on their official website. The XM Live and Live Education keeps the traders updated with the latest events concerning the forex and CFD capital markets. They also organize various webinars and seminars to educate the traders and promote the capital markets.

-

Research and Analysis: XM publishes market overview and news concerning the forex market to assist in the prediction of price movement. The XM research provides analysis reports, technical summaries, MQL5 calls, and various other features to enhance the profit-making opportunities of the traders.

The variations in the account types allow all types of traders to have a convenient trading experience. We liked the Ultra-Low Standard account due to low spreads and no commission.

Trading Instruments

Following trading, instruments are available to trade at XM with the Standard, Micro, and Ultra-Low accounts.

If we count all the instruments, the number is significantly high in comparison with other forex and CFD brokers. However, if we separate the number of stock CFDs from the total, the number of the instrument are decent.

Research and Education

We found XM to be very impressive in the segment of research and education. It offers a variety of tools to educate the traders and assist them in making better trading decisions through multiple research and analysis tools.

Deposits and Withdrawals

The lowest cap on deposits & withdrawals is $5 for all the available methods but also depends on the account type chosen. There is no commission involved from the broker’s side on any of the available transaction methods. The third-party e-wallets can charge a commission on their side if liable.

Traders in Philippines cannot deposit through local bank transfer but can deposit/withdraw through bank wire transfer, credit/debit cards, and e-wallets.

Compared to other regulated peers in Philippines, we give it an average rating as XM do not accept cryptocurrency nor do they offer local bank deposits in the Philippines.

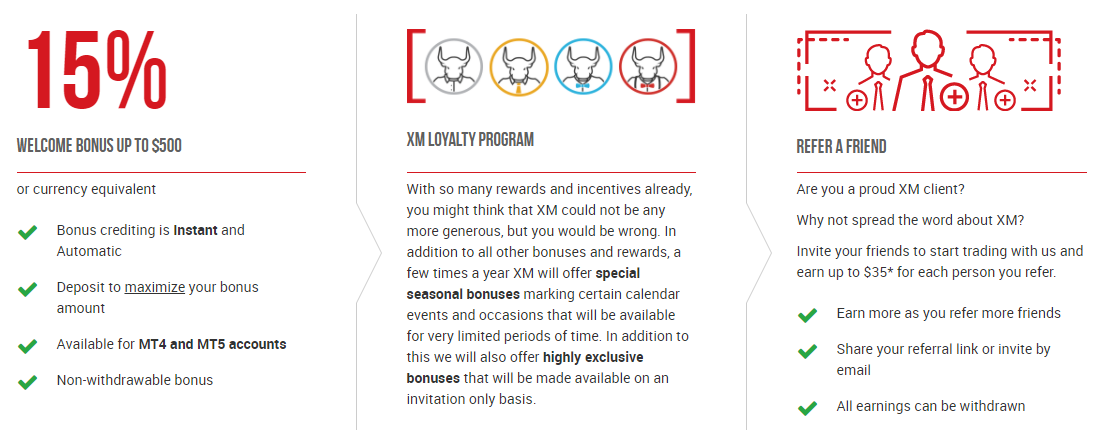

XM Philippines Bonus

XM has a decent bonus offering for promotional activity. At the time of this review, they are offering a welcome bonus of 15% up to 500$. This bonus is non-withdrawable but the profits booked with this amount can be withdrawn.

They also have an ongoing loyalty program in which they provide special seasonal bonuses to some of the high-volume traders exclusively. Traders can also earn up to 35$ for each successful referrals. The referral bonus amount can be withdrawn anytime. Any fees charged via credit card, e-wallet, and wire transfer of more than 200$ are instantly refunded back to the traders’ wallet.

Do we Recommend XM?

Yes, XM is a well-regulated forex broker that is cost-effective and offers a wide variety of research and educational tools. The spreads with the ultra-low account are attractive and the basket of numerous trading instruments is a major advantage of choosing XM.

The unavailability of PHP based trading account, local phone number for customer support can be an obstacle of choosing XM in Philippines. Although, it is a much better option compared to many of the regulated market maker forex brokers in Philippines.

XM Philippines